The Contributing the proceeds of downsizing into superannuation measure was one of several announced in the 2017–18 Budget as part of the government’s package of reforms to reduce pressure on housing affordability in Australia.

The Contributing the proceeds of downsizing into superannuation measure was one of several announced in the 2017–18 Budget as part of the government’s package of reforms to reduce pressure on housing affordability in Australia.

As of 1 July 2018, if you are 65 years old or older and meet the eligibility requirements, you may be able to choose to make a downsizer contribution into your superannuation of up to $300,000 from the proceeds of selling your home.

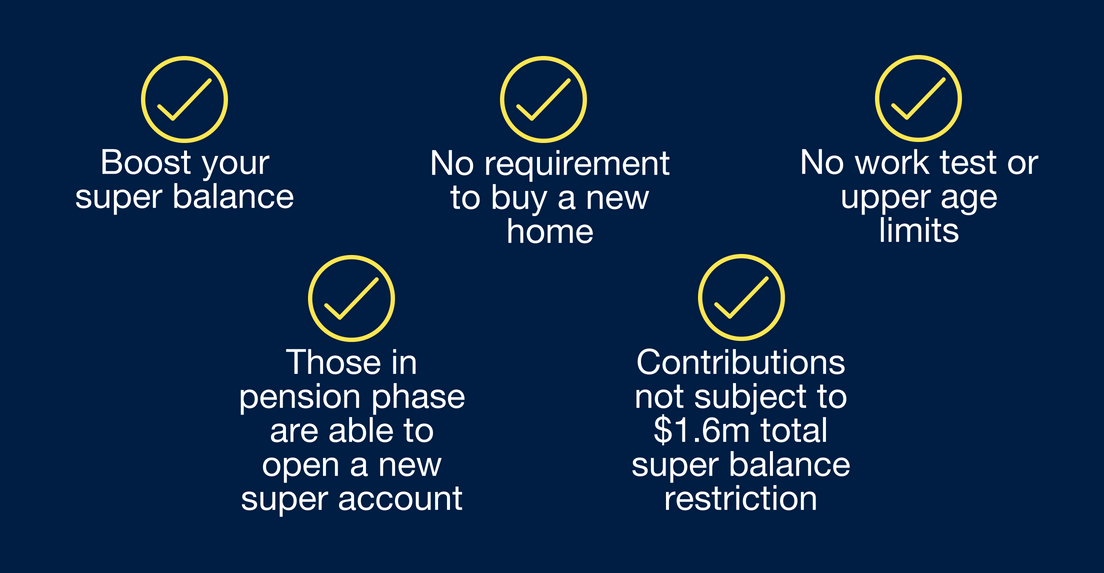

Your downsizer contribution is not a non-concessional contribution and will not count towards your contributions caps. The downsizer contribution can still be made even if you have a total super balance greater than $1.6 million.

Your downsizer contribution will not affect your total super balance until your total super balance is re-calculated to include all your contributions, including your downsizer contributions, on 30 June at the end of the financial year.

The downsizer contribution will also count towards your transfer balance cap, currently set at $1.6 million. This cap applies when you move your super savings into retirement phase.

You can only make downsizing contributions for the sale of one home. You can’t access it again for the sale of a second home.

Downsizer contributions are not tax deductible and will be taken into account for determining eligibility for the age pension.

If you sell your home, are eligible and choose to make a downsizer contribution, there is no requirement for you to purchase another home.

Eligibility

You will be eligible to make a downsizer contribution to super if you can answer yes to all of the following:

- you are 65 years old or older at the time you make a downsizer contribution (there is no maximum age limit)

- the amount you are contributing is from the proceeds of selling your home where the contract of sale exchanged on or after 1 July 2018

- your home was owned by you or your spouse for 10 years or more prior to the sale – the ownership period is generally calculated from the date of settlement of purchase to the date of settlement of sale

- your home is in Australia and is not a caravan, houseboat or other mobile home

- the proceeds (capital gain or loss) from the sale of the home are either exempt or partially exempt from capital gains tax (CGT) under the main residence exemption, or would be entitled to such an exemption if the home was a CGT rather than a pre-CGT (acquired before 20 September 1985) asset

- you have provided your super fund with the Downsizer contribution into super form either before or at the time of making your downsizer contribution

- you make your downsizer contribution within 90 days of receiving the proceeds of sale, which is usually at the date of settlement

- you have not previously made a downsizer contribution to your super from the sale of another home.

What does this really mean for you?

For many Australians who are wanting to downsize this change in superannuation could be a way to release some built up equity in order to fund retirement. Retirees who don’t have sufficient funds for a comfortable retirement could use the proceeds to top up their super balance using the beneficial tax environment of the super system. Earnings received on a super balance are only taxed at 15% (or are tax-exempt if rolled into a retirement income stream), rather than taxed at the person’s normal marginal tax rate.

After making the downsizer contribution, there is no requirement to buy a cheaper or smaller home and conversely, it’s possible to purchase a larger or more expensive replacement home.

Additional rules may apply to your situation, so make sure you do your research before making any decisions.

For more information, visit the ATO.

To discuss this downsizer opportunity and find out what your home is worth in today’s market, call 02 8030 2552 or email salesnorthshore@savills.com.au.